quantilope’s recent women's razor study (with insights from n=396 US females, aged 18+) showcases how brands can leverage advanced research methods to support their shopper insights team.

This study has a particular focus on how to arm shopper insights teams with the right data to convince retailers that certain products belong on their store shelves. In this case, we looked at what’s the optimal combination of female razors to reach the highest number of consumers. The results from this study can be used by brands and retailers to optimize both product line reach and shelf space - in this case for women’s disposable razors/blades - though this methodology is applicable to retailers and brands across any CPG category.

TURF:

In order to select the brands to test in this study, we opted to simulate a shelf space similar to what consumers would see when browsing an online website for women's razors. This includes a mix of brands, at different price points, with a varying number of blades/handles included in each product package. We then leveraged a TURF (Total Unduplicated Reach and Frequency) analysis to measure purchase likelihood of these various razor and handle options, to ultimately identify the ideal combination of products to reach the maximum number of consumers, while minimizing cannibalization.

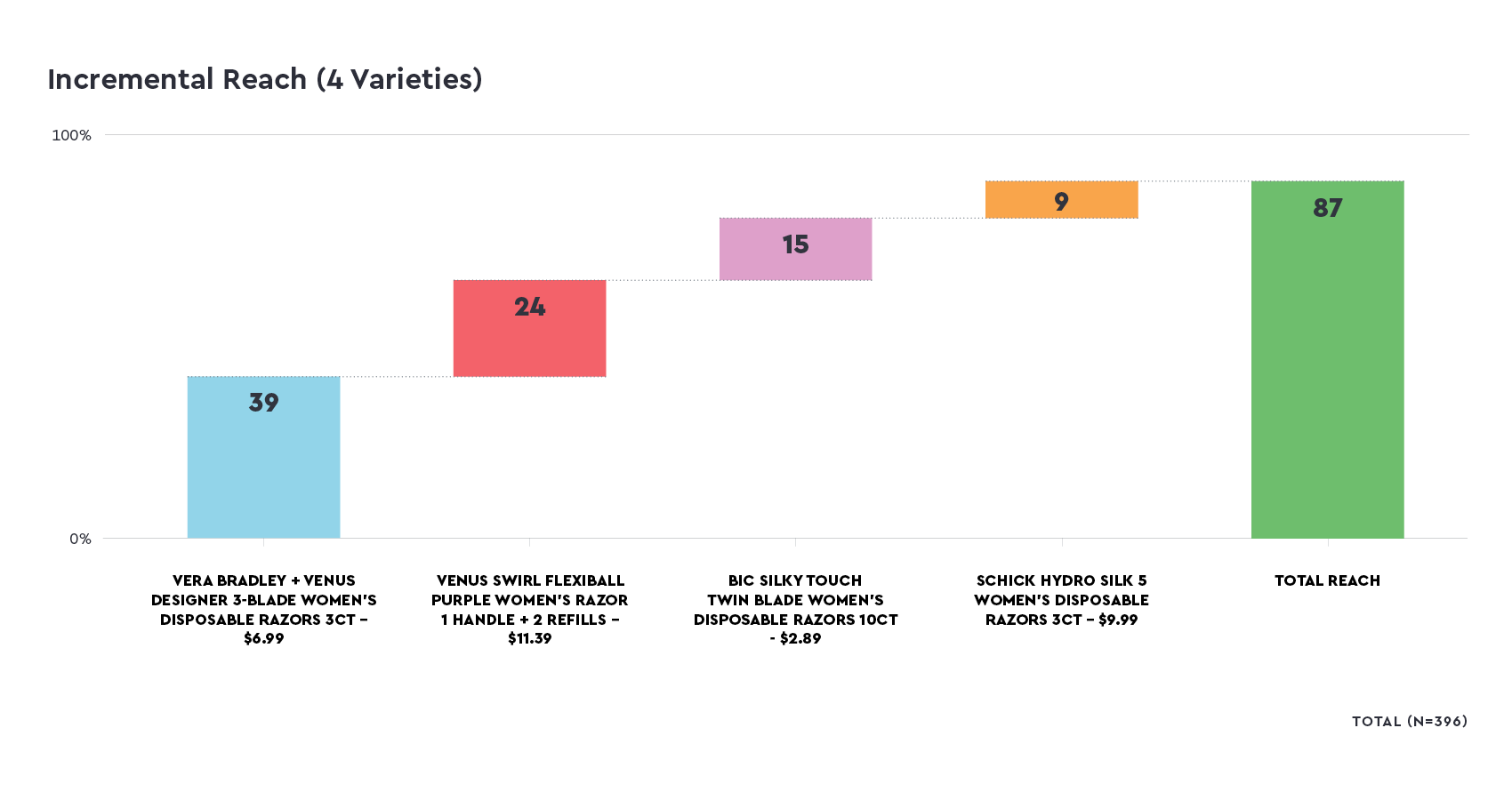

Below is a quick snapshot of our TURF methodology in action:

As shown below, the TURF results indicate the power of co-branding, with a Vera Bradley + Venus razor holding the highest individual reach (39%). In fact, 71% of razor shoppers would be more inclined to purchase a razor that is partnered with a brand they like. By incrementally adding products with the next highest reach (Venus Swirl Flexiball Purple: 24%, BIC Silky Touch Twin Blade: 15%, and Schick Hydro Silk: 9%), retailers have the potential to reach 87% of the overall female razor market (when offering just these 4 products alone). With this data, brands can approach retailers with concrete support as to why they deserve valuable shelf space in stores.

Shopping Behaviors:

Beyond product and shelf space optimization, our shopper insights study highlights specific details in the consumer’s buyer journey. In this particular study, 43% of women say they look for both a razor and blade refill combo when shopping for razors, and 69% would prefer their razor is sustainably made. Should their preferred razor be unavailable, 38% would buy a different brand at the same store, and 33% would purchase another razor from the same brand. However, consumers tend to make substitutions at similar price points, suggesting that price is a more important factor for female razor shoppers than brand/product loyalty.

From this study we also uncover grooming habits that could drive purchase frequency and additional product interest. Forty-four percent of women change their razor blades 1-2 times per month, which may influence their decision to buy a product with a certain number of razor blades that fits how frequently they shop. Additionally, 52% say they typically use an aftershave/moisturizing product, and 51% use shaving cream every time they shave. Knowing this, retailers may benefit from offering promotions or discounts when bundling these items together.

Takeaway:

Successful CPG brands will be those who are viewed as a valued partner to retailers, by leveraging advanced research in their shopper insights teams to understand which product set will optimize customer reach, without cannibalizing high performing products. Retailers should also be using this type of study for data-supported decisions on which products to swap out on their limited shelf space.