Automated Mental Availability Analysis

Based on the work of Professor Jenni Romaniuk (of the Ehrenberg-Bass Institute for Marketing Science), Mental Availability analysis is a measure of how easily and readily a brand comes to mind in a specific buying scenario (known as Category Entry Points).

quantilope's automated Mental Availability analysis includes four key metrics that can be leveraged in any quantilope tracking study - Mental Market Share, Mental Penetration, Network Size, and Share of Mind.

Benefits of leveraging Mental Availability analysis

Grow your brand:

Understanding when and why consumers think of a brand helps businesses identify opportunities/gaps in the market.

Optimize campaigns:

Insights from Mental Availability analysis can help marketers develop more effective campaigns that resonate with consumers.

Build brand equity:

By consistently appearing in consumers' minds in relevant situations, a brand can build stronger associations and solidify its position in the market.

Mental Availability metrics

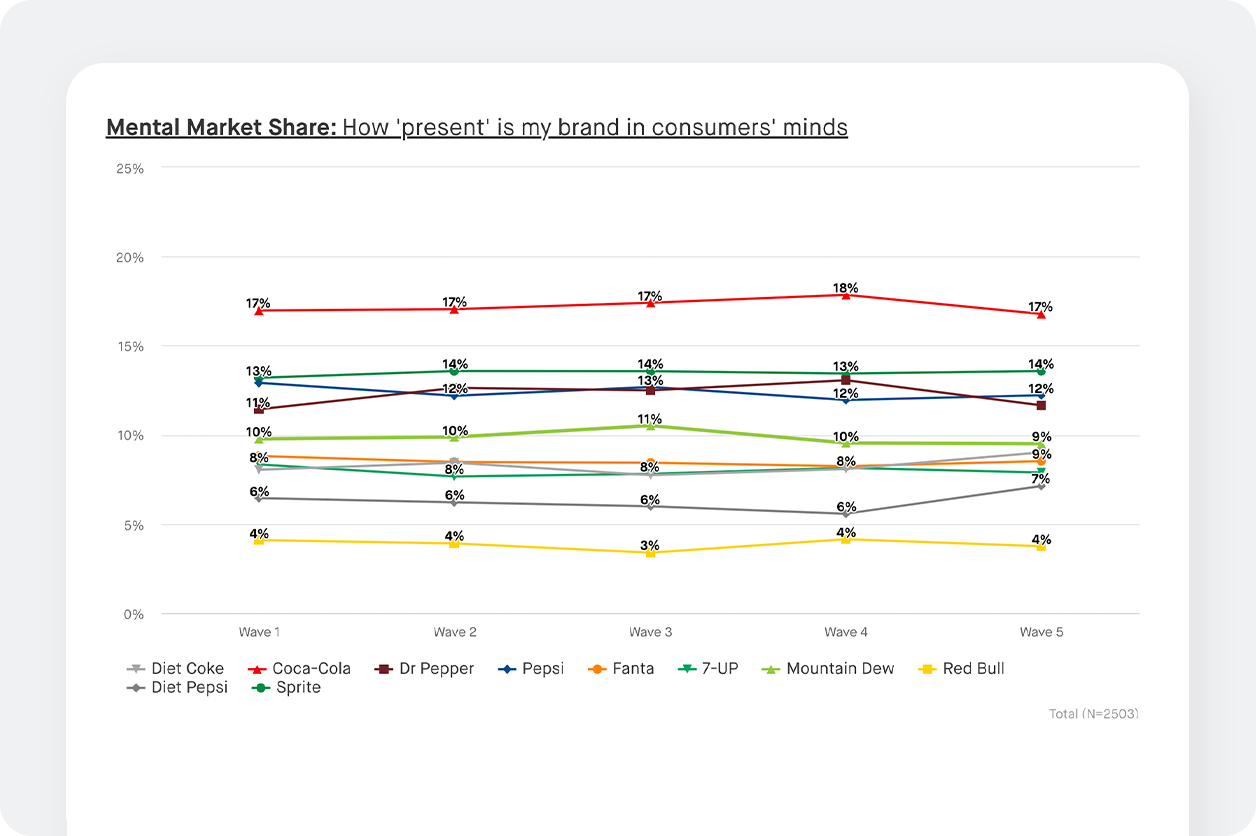

Mental Market Share (MMS):

How present a brand is in consumers’ minds with regard to all Category Entry Points (CEPs).

If MMS is higher than actual sales market share, consumers might face physical barriers for the purchase. Investigate physical availability in order to leverage your brand’s full potential.

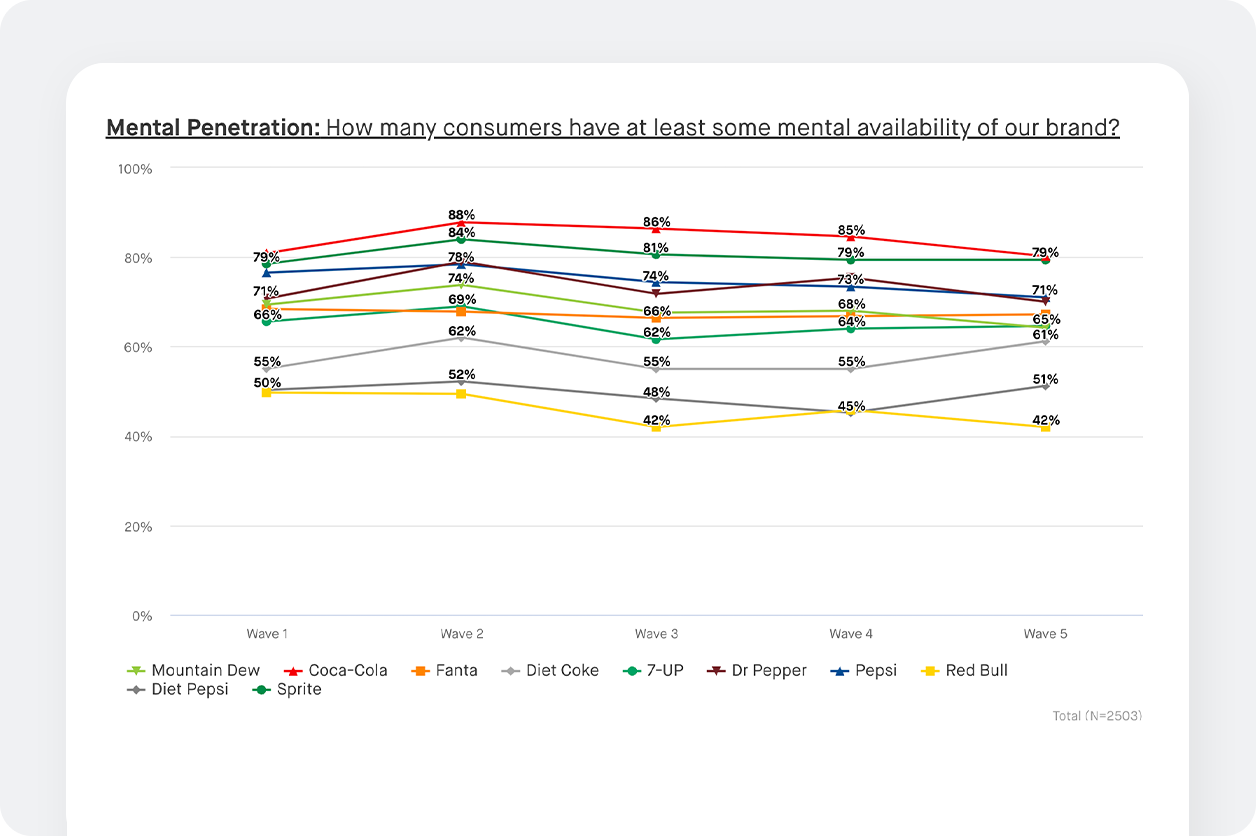

Mental Penetration (MPen):

How many consumers have at least some mental availability of a brand.

MPen is most interesting for non-buyers because this clearly outlines your brand’s growth potential. If you create just one connection with existing non-buyers of your brand, your MPen will increase. Focusing on higher reach (or broadening your target audience) can aid in increasing MPen.

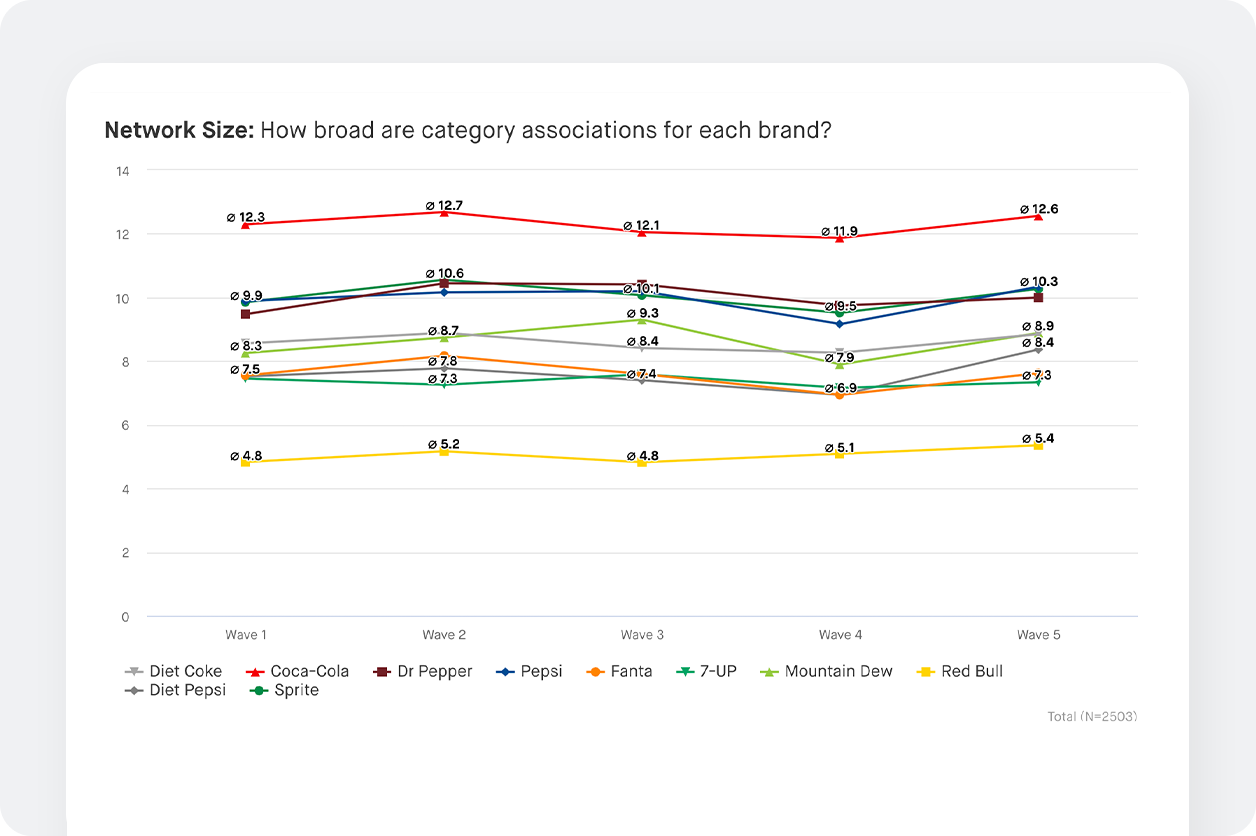

Network Size (NS):

How broad/varied category associations are for each brand in your category.

If brands rank higher in Network Size than MPen, brands are struggling to reach new buyers and instead are broadening existing networks. Conversely, if brands rank relatively higher in MPen than NS, this indicates that messaging should be broader - or the branding of existing comms should be closely reviewed.

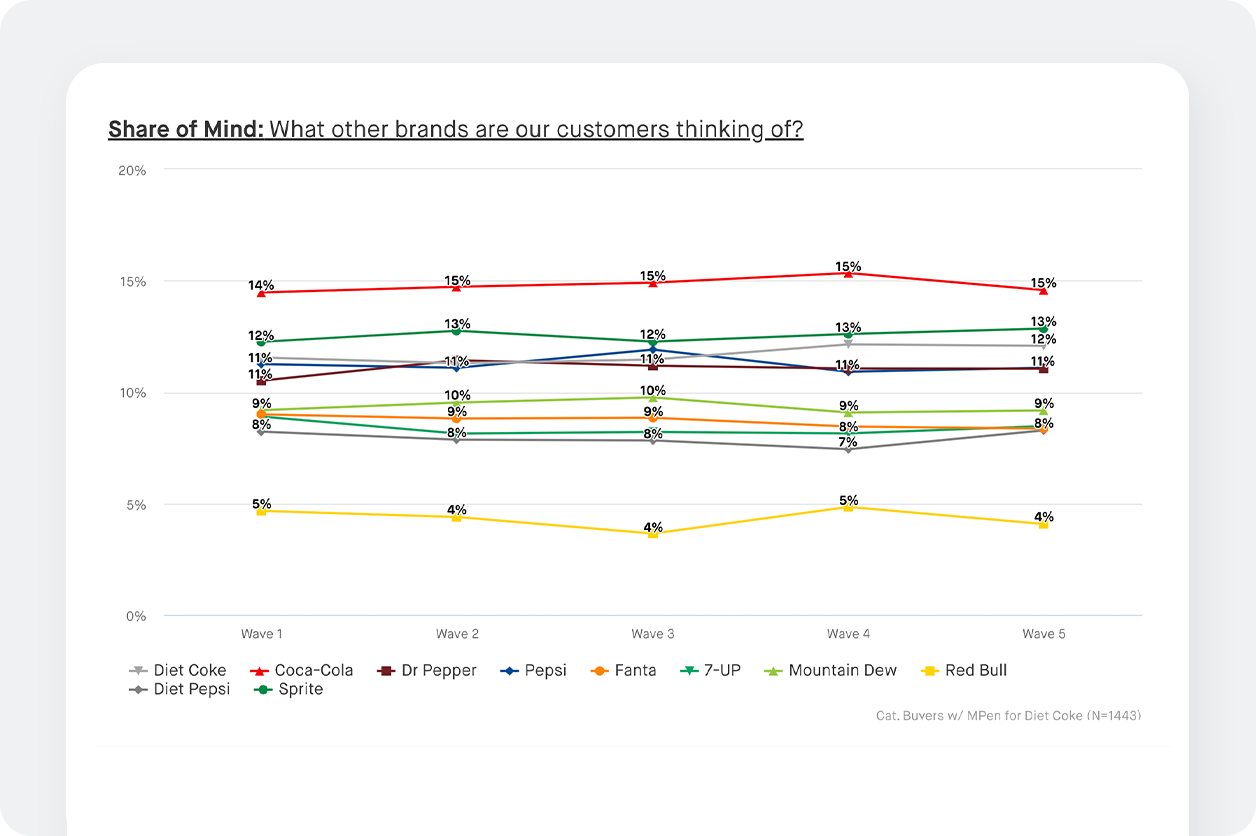

Share of Mind (SoM):

What other brands customers are thinking of in addition to a specific brand?

Share of Mind tracks how your competitors impact the people that are most interesting for your brand (people who have you mentally available). SoM is usually more interesting for bigger brands, especially among brand buyers as it can indicate that competitors might be “stealing” a brand’s buyers.

“It’s exciting to see quantilope automate a new, innovative approach to

brand health tracking - introducing new metrics from the Ehrenberg-Bass Institute that unlock actionable insights right out of the gate and identify

opportunities for brand growth..”

-Kelly Wade, Director of Marketing

Additional automated advanced methods

Request a Mental Availability analysis demo