The Consumer NOW Index is an on-going tracker focused on consumer sentiments, attitudes, and actions in the US, UK, and Germany (aged 18-70). The analysis of each wave is based on advanced research methods from quantitative market research including a Key Driver Analysis, MaxDiff, and an Implicit Association Test.

Here, we will focus on the results from the MaxDiff and provide a deeper explanation into how the method works and best practices to interpret the results. You can find information about the MaxDiff and the insights we've have gathered from the Consumer NOW Index in the interactive MaxDiff dashboard.

What is Maximum Difference Scaling (MaxDiff)?

MaxDiff is used to identify consumers' preferences towards product features, advertising claims, or branding. It’s used to understand which items to prioritize by asking respondents to make trade-offs between the items. These forced trade-off decisions indirectly determine a valid importance ranking by preventing respondents from marking "everything as important" (also known as "ceiling effect").

Typical MaxDiff research questions:

- What product features are the most important for the decision to buy?

- Do different target groups have the same needs?

- What advertising slogans do consumer find the most appealing?

- Which products in the online shop have the greatest potential?

MaxDiff findings from the Consumer NOW Index Wave 5

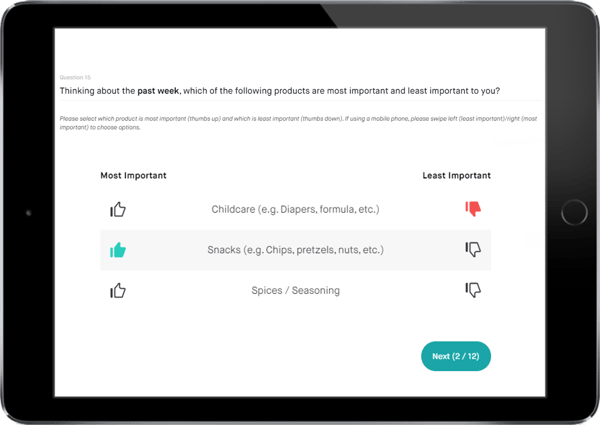

In each wave of the Index, we ask consumers "thinking about the past week, which of the following products are the most important and the least important to you?"

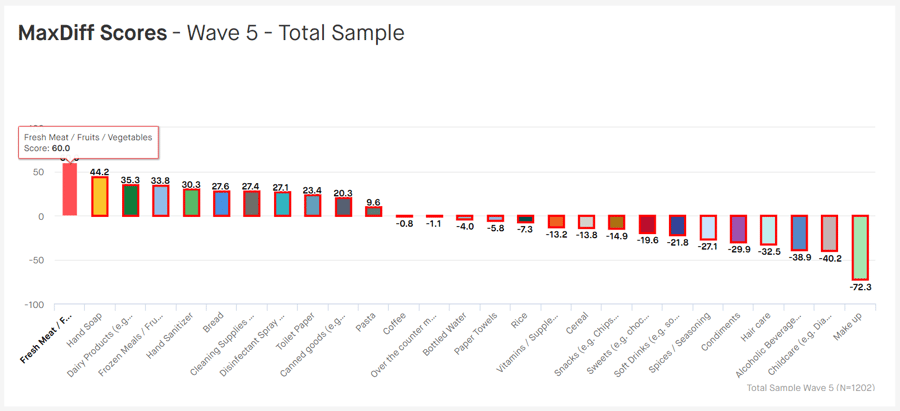

In wave 5 of the Index, the MaxDiff shows that the most important products for consumers fresh meats/fresh produce and hand soap. Less important are personal care products and non-essential products (e.g. alcoholic beverages, make-up).

The MaxDiff score is the percentage of how often an item is chosen as the best option minus the percentage of how often an item is chosen as worst option. The higher the score the more important/preferred the item is.

How are the MaxDiff scores measured?

In the survey, participants choose the best (or most important) and worst (or least important) item for each set of alternatives. These decisions are then used to determine a preference/importance ranking using the MaxDiff scores.

Today Top — Tomorrow Flop

Throughout the Consumer NOW Index, the MaxDiff has proven that consumer preferences and priorities shift during times of uncertainty. While hand disinfectants tend to increase in importance throughout waves, the importance of toilet paper increased initially, but now seems to be decreasing again. Disinfectant spray was especially relevant for waves 2 and 3 (27th March to 8th April), but less so for wave 4 (10th to 15th April). For some products we are observing a kind of "up and down" pattern (e.g. for medicine or canned food). It is possible that these products will become relevant whenever they are currently consumed and need to be bought again.

Women rely on soap

The MaxDiff presents particularly interesting insights when you split by different segment groups. For instance, bread and coffee are more important for the older generation (39-69), while the younger cohort (18-38) tends to consider canned food more important. We observe a very big difference when it comes to care products for children (e.g. diapers). These are much less important for the older cohort. Probably because they are less likely to be parents of young children. In a gender comparison, women clearly prefer hand soap more often than men. While men consider soft drinks more important than women.

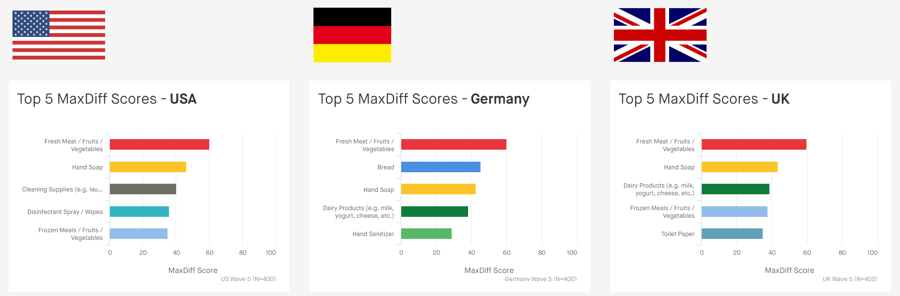

People from Germany love their bread

The comparison between the countries confirms the cliché: bread is preferred more often among German respondents than in the USA and UK. The US respondents attach greater importance to cleaning products and in UK toilet paper makes it into the top 5 products.

Benefits of quantilope's MaxDiff:

- Provides automatic suggestions for optimal survey designs

- Set up within a few minutes

- Intuitive analyses and comparisons of sub-segments

- Gamified approach for respondents

You can find exciting insights that we have gathered with the help of our MaxDiff in the interactive dashboard.

Click here for the free generic Insights Dashboard: Consumer NOW Index.

Here you can access the US-specific insights.

We recommend opening it on a large screen and zooming in or out as needed.