The Consumer NOW Index is an on-going tracker focused on consumer sentiments, attitudes, and actions in the US, UK, and Germany (aged 18-70).

While this article deals in particular with the new insights from waves 3 (03.04 to 08.04) and 4 (10.04 to 15.04), you can find a summary of the results from the previous two waves here.

A positive development in the consumer mood

In wave 3 and 4 of the Consumer NOW Index we see the current mood of the respondents continues to develop positively. Almost every second person stated that they currently have a positive mood with regard to their everyday life. The percentage of those who said they had a negative mood even decreased significantly, from 24% in wave 1 to 17% in wave 4.

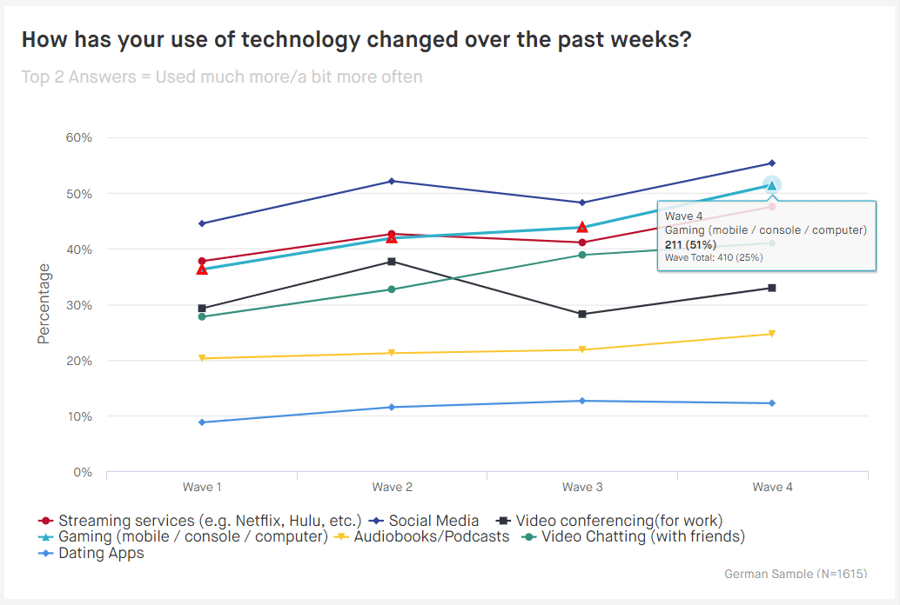

The drivers of the current mood continue to be relaxation, sleep and healthy eating. What is new, however, is that the use of gaming services (mobile, PC or console) was a major driver of mood in wave 4.

- For brands in the gaming industry, this offers an opportunity to meet the current needs of consumers with their product range.

Fear is decreasing, restrictions and feelings of isolation are increasing

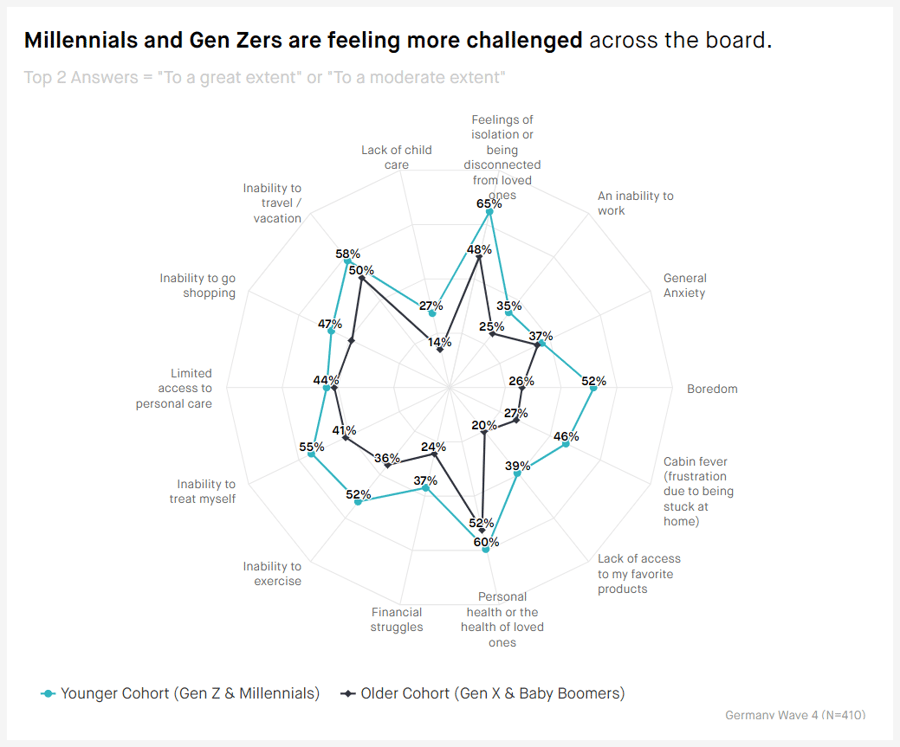

In wave 4, significantly fewer consumers perceive "general anxiety" as a challenge (36%), compared to wave 2 (43%). On the other hand, the inability to travel and feelings of isolation are perceived more as a challenge.

The younger generations (Generation Z and Millennials, 18-38 years) still feel more challenged by the current situation than the older generations (Generation X and baby boomers, 39-69 years).

- In communication, brands can focus on offers that counteract the feeling of isolation and can help in case of lack of employment (e.g. games). It is particularly important to address the younger generation, which is subjectively more affected.

Increased use of social media, gaming and streaming services

Technologies such as social media, gaming and streaming services are being used at an increasing frequency. Especially when it comes to gaming (mobile, console or computer), a significant increase in usage can be noted, with 51% of respondents reporting having played more often in the past week.

- Marketing and brand managers should keep an eye on these developments and take them into account in their advertising activities, as some of these behaviours could become new habits.

The current purchase behaviour

As far as purchase behaviour is concerned, there are only slight changes from week to week. The most important products for consumers continue to be fresh food, soap and bread. Less important are non-essential products (e.g. alcoholic beverages, make-up).

Pharmaceutical products were bought less in wave 4 (- 1.9% compared to wave 3). In addition, consumers tend to spend more money on sweets than in the previous waves. In terms of spending behavior, medicine also declined slightly from wave 2 to wave 3, while spending on games and TV streaming increased.

Click here for the free Insights Dashboard: Consumer NOW Index.

For best viewing, we recommend opening the Dashboard on the desktop.

Click here to access the US-specific insights.

An individual Consumer Now Index Tracker is available from quantilope on request.