Following endless news stories about Beyond Meat’s stock price and the number of restaurants adding similar products to their menus, we decided that it was finally time to ask consumers how they really felt about the booming food obsession.

To do so, we ran a TURF analysis with 488 US consumers who purchase plant-based meat alternative products or would be open to purchasing plant-based meat alternative products. As it turns out, burger patties are the single most popular product among plant-based meat alternatives. On its own, the plant-based burger patty appeals to 65 percent of the target group. On the opposite end, deli-meat slices and chicken wings have the lowest individual reach, appealing to just 6.6 and 7.8 percent of consumers each.

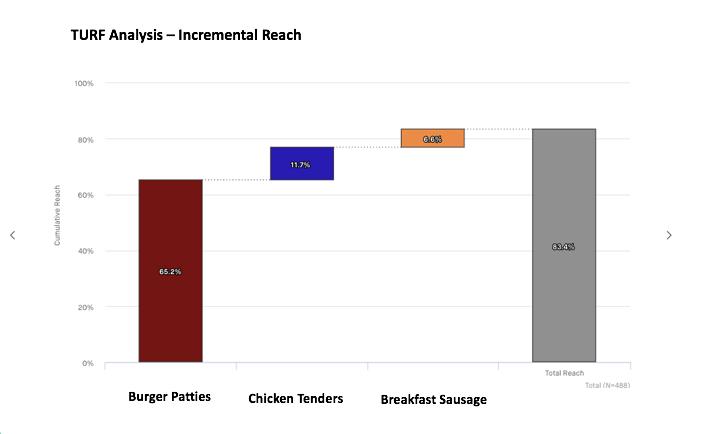

For brands looking to join the Beyond Meat craze, this means that you should focus your resources on introducing some type of meat-alternative burger into your product mix. However, if you're a brand who already produces meatless burger patties and want to extend your product line, the best product type to introduce is chicken tenders. When produced with burger patties, meat-alternative chicken tenders add an incremental reach of nearly 12 percent of the target group. The next best product to maximize reach is meat-alternative breakfast sausages which add an additional 7 percent. When producing meat-alternative burger patties, chicken tenders, and breakfast sausages together, a brand can reach 83 percent of the entire group of consumers who purchase plant-based meat alternative products or would be open to purchasing plant-based meat alternative products.

Data from the brand funnel tells us a different story to what current media coverage may have you think. Beyond Meat and Impossible Foods are not at the top of the list in regards to aided awareness and consideration among consumers. MorningStar Farms leads the pack with 65 percent awareness and 54 percent consideration of our total sample (aged 18 - 69). Comparatively, Beyond Meat’s aided brand awareness comes in at 39 percent of the total group and Impossible Food at 27 percent.

Regardless of the current brand funnel, both Beyond Meat and Impossible Foods have no doubt have further growth in them, especially among the youngest 18-29 cohort. Beyond Meat is even expected to release their own Steak and Bacon alternatives soon.