To better understand the skincare shopper persona, quantilope surveyed 400 US females (18-69) who have purchased a skincare product for their face in the past 6 months.

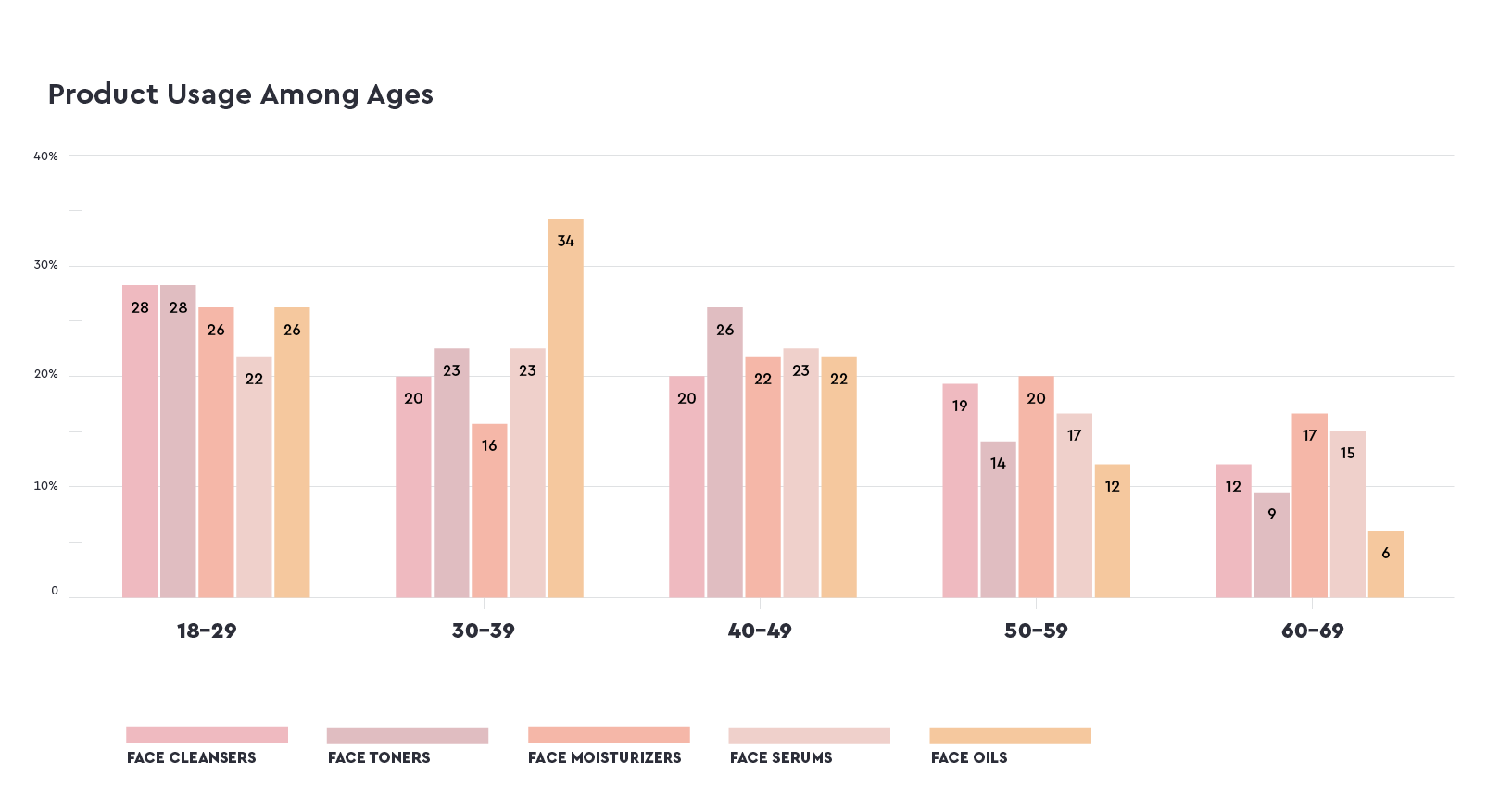

To start, we looked at the general types of products consumers are using. Eighty percent of skincare consumers are using cleansers and moisturizers, which is more than double the use of serums (39%), toners (37%), and oils (21%). Younger generations are generally more likely to use the above-mentioned products than older generations (about a quarter or more of 18-29-year-olds are using each product compared to just 17% or less of 60-69-year-olds). One explanation for this difference in behavior could be that brands are able to target younger generations with entire skincare regimens through social media ads or celebrity endorsements, considering 18-29-year-olds’ skincare purchases are most influenced by Influencer accounts (50%), Instagram ads (47%), and YouTube ads (45%). Older generations may stick to using their few tried and true products.

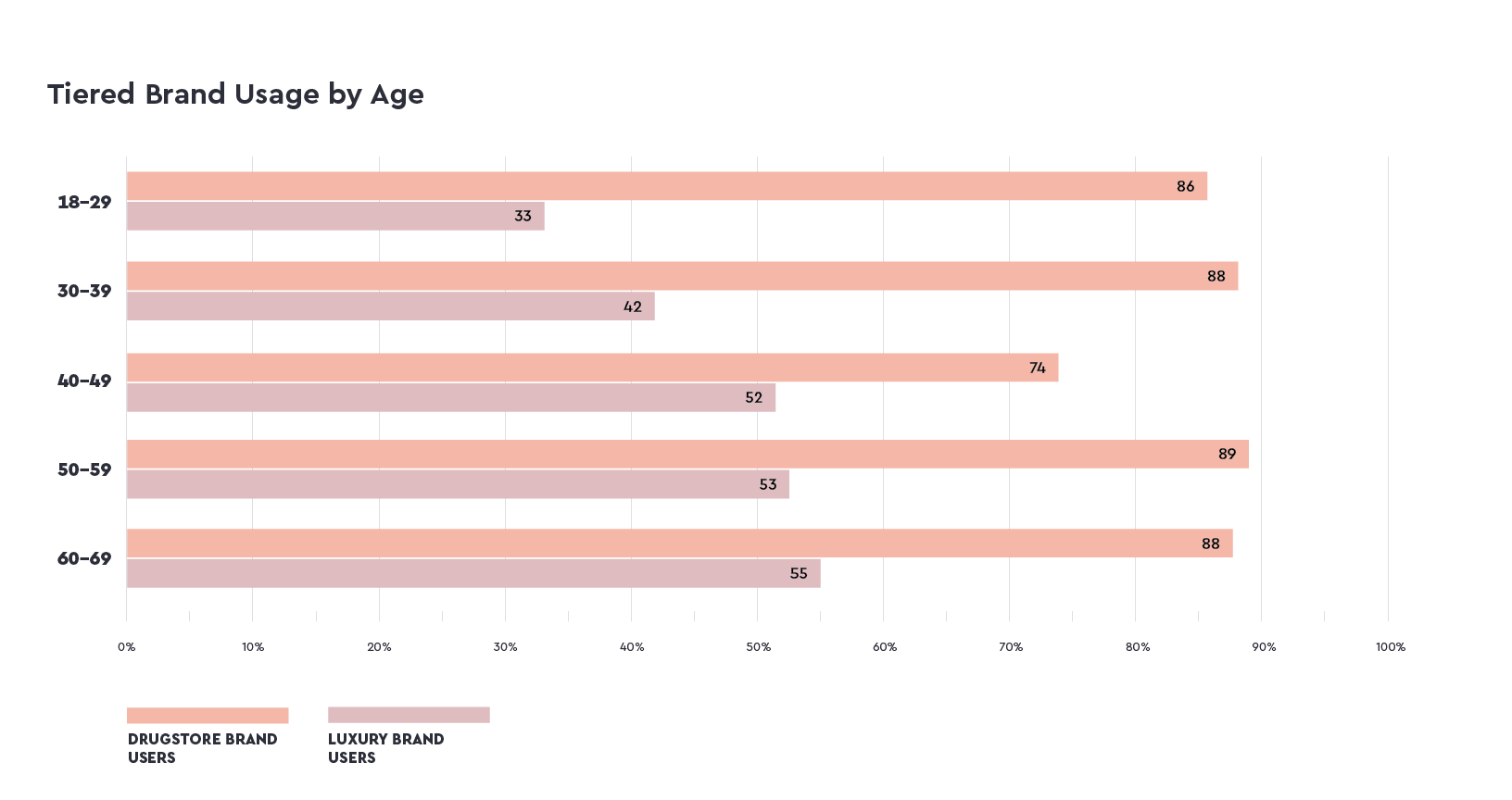

When it comes to brand performance, Olay, Neutrogena, and Aveeno dominate with regard to aided awareness (each over 80%), as well as brand usage (each over 40%). These brand perceptions support the skew observed in drugstore brand usage (85%) compared to that of luxury brands (46%). This skew could be due to the majority of skincare shoppers (61%) who purchase their products at mass retailers (such as Target or Walmart) where they are already tackling their other shopping.

Once again looking into the contrasting perceptions among ages, consumers gradually introduce luxury brands to their skincare routines as they age up (starting at just 33% among 18-29-year-olds, compared to 55% of those 60-69). Knowing that social media has such a huge influence on younger generations, luxury skincare brands can consider this as an avenue to better target their products and close this age gap sooner.

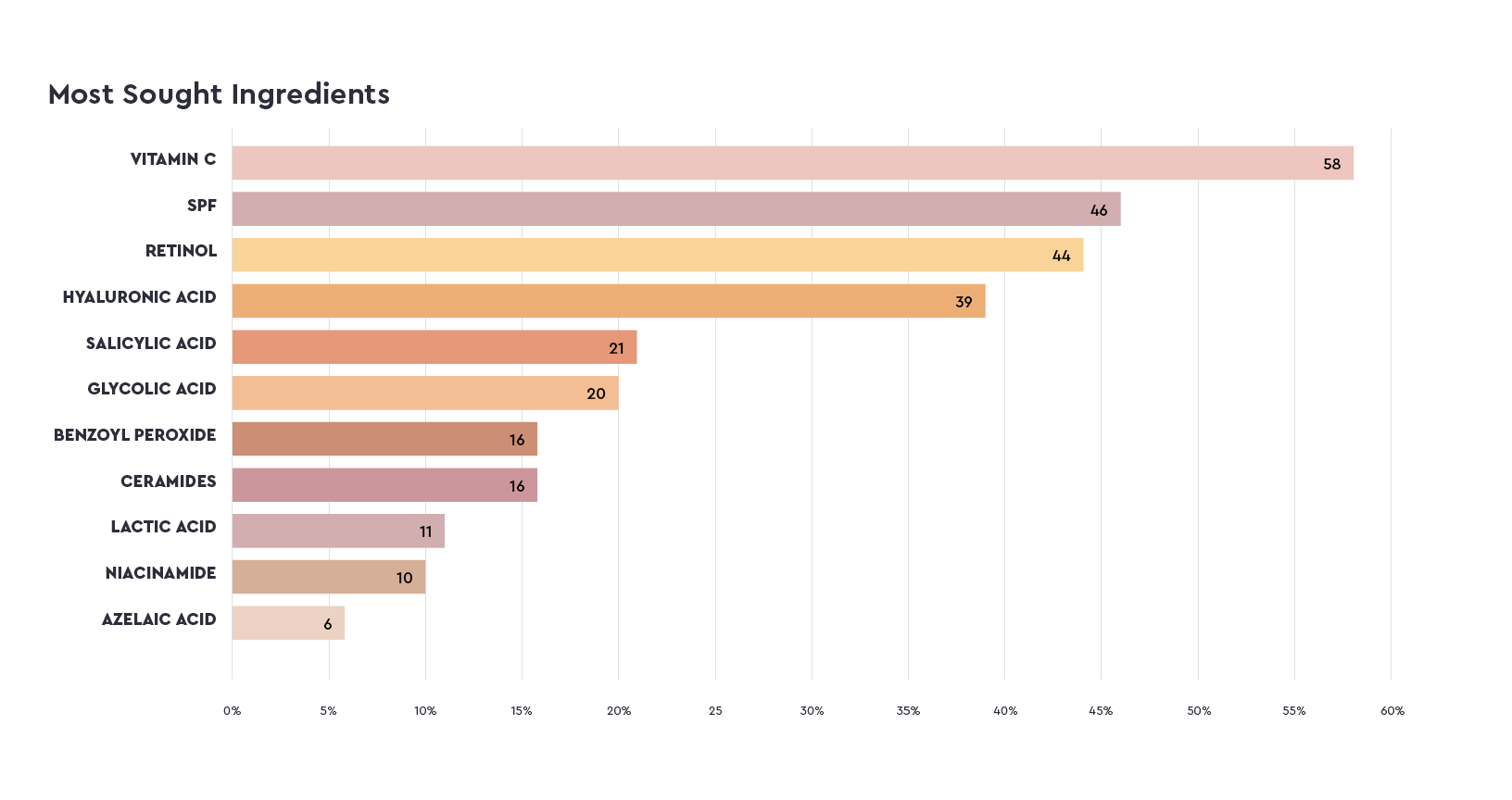

Aside from product usage and brand preference, consumers care about the ingredients going into their skincare products, particularly Vitamin C (58%), SPF (46%), and Retinol (44%). Young skincare shoppers (18-29) are most drawn to products with Vitamin C in them (71%). As consumers age up, the emphasis on Vitamin C is gradually replaced by an increasing need for Retinol (58% among 60-69-year-olds). Meanwhile, few skincare shoppers look for lactic acid, niacinamide, or azelaic acid, perhaps for a lack of awareness of the ingredients. To increase familiarity with the benefits of these ingredients, brands can consider launching educational campaigns focused on each ingredient and how they enhance a skincare product (i.e. “Reveal your most radiant complexion through the exfoliating powers of our lactic acid serum, which works by loosening the bonds between dead skin cells and stimulating the production of new ones to brighten, smooth, and even out your skin”).

Skincare consumers however do not have a preference for their skincare products’ scent. About half (46%) prefer unscented skincare products while more than a third (37%) have no preference at all. Brands should consider shifting budgets dedicated to fragrance to secure the highest quality ingredients for their products.

Skincare consumers however do not have a preference for their skincare products’ scent. About half (46%) prefer unscented skincare products while more than a third (37%) have no preference at all. Brands should consider shifting budgets dedicated to fragrance to secure the highest quality ingredients for their products.

The full insights dashboard, including a closer look into skincare personas, brand preference, shopping behaviors, and advertising influence can be found below.