With American consumers paying closer attention to their health and well-being in light of a vulnerable past year, quantilope surveyed 500 US respondents to uncover food and beverage trends brands should be conscious of in 2021.

Dietary Profiles:

Overall, the US is mostly an omnivorous nation, with 58% of respondents consuming food of both plant and animal origin. However, plant-based diet trends have big potential, with 57% of omnivores mentioning they would be open to trying a new plant-based alternative as a substitute to their favorite meat product; these consumers, in addition to consumers who follow a vegetarian, pescatarian, or vegan diet, consider these diets primarily for health reasons (especially those above the age of 55).

Health Focus:

Health is going to be a huge focus in consumers’ diets in 2021. 64% of vegetarians and 73% of pescatarians/vegans mention ‘health’ as their number one driver for their dietary habits (even over animal welfare), compared to just 43% of omnivores.

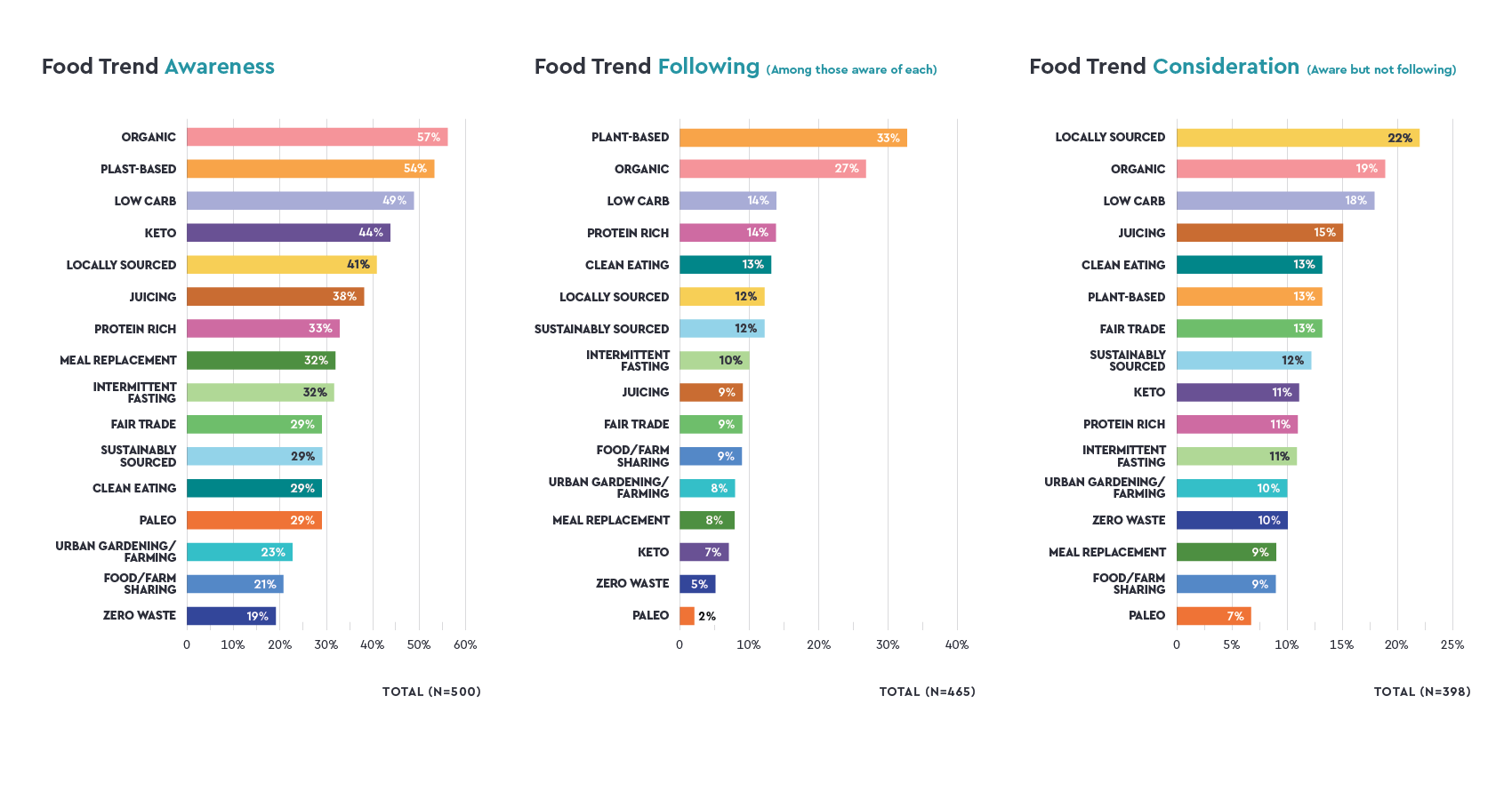

As shown below, Organic and Plant-based diets are the most well-known, and most followed, diet trends among consumers; 57% percent of consumers are aware of organic diets, with 27% regularly consuming these types of foods. Similarly, 54% of consumers are aware of meat alternative and plant-based diet trends, with a slightly higher following (33%). Interestingly, the top considered food trend is neither of these - it’s actually Locally Sourced diets that consumers would be most likely to consider (22%).

Sustainability:

Along with an emphasis on health, 55% of consumers say it is important to them that the brands they buy emphasize sustainability in their products. And when asked which food brands come to mind when consumers think about sustainability, the following were most frequently mentioned: Amy’s, Annie’s, Beyond Meat, Chobani, Clif, Impossible, Kellogg's, Kraft, Morningstar Farms, Nestlé, Organic Valley, and Silk.

Beyond Meat in particular appears to be making headlines for their efforts in building a more sustainable food system. They just recently announced a partnership with PepsiCo to develop a line of snacks and beverages with plant-based protein. This is a great example of how plant-based brands can gain traction in the market through reputable co-branding and extended product lines.

Packaging Claims:

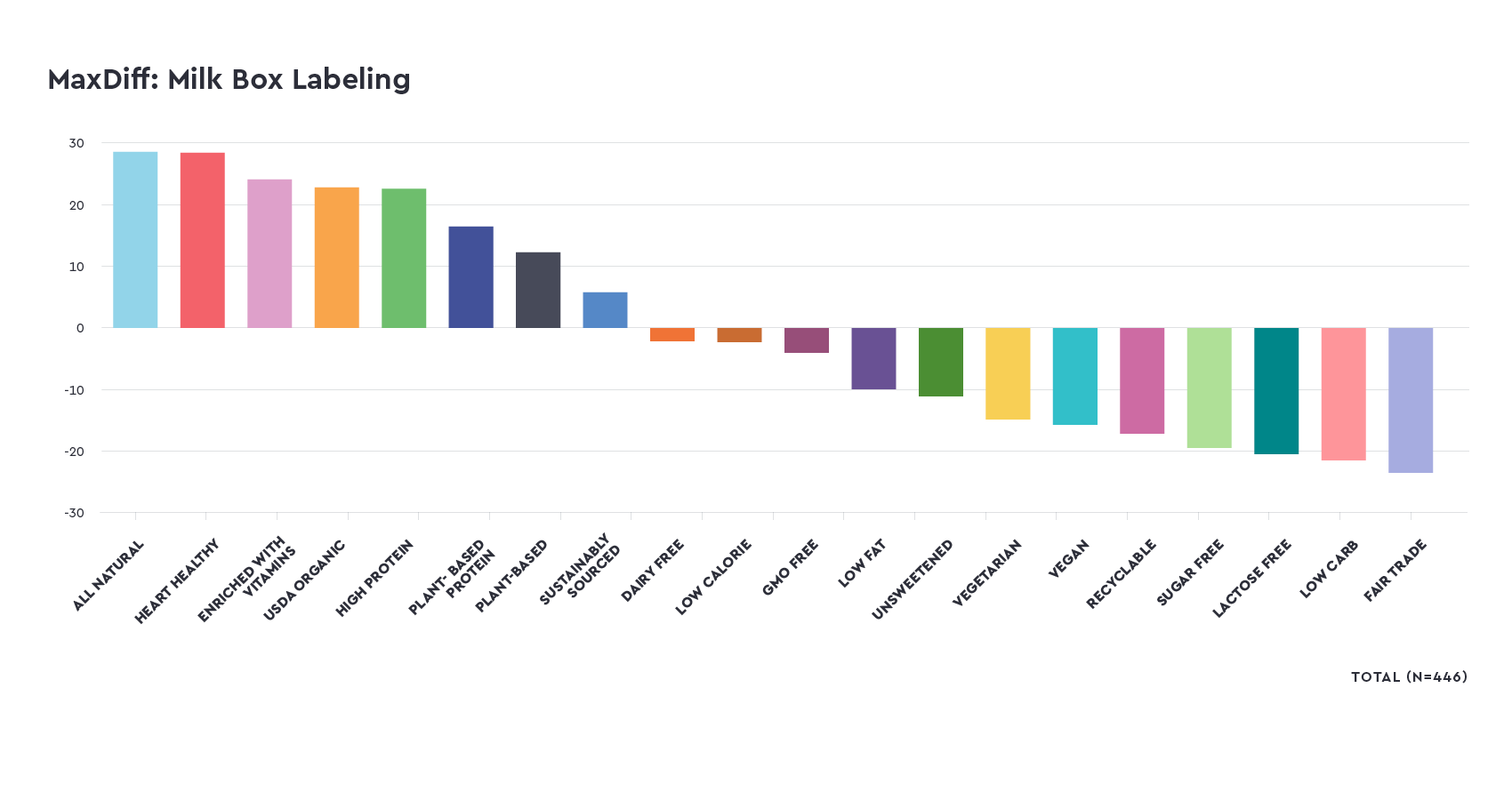

This study leveraged a MaxDiff analysis as a guide for product labeling (using milk/milk alternatives as an example). Consumers were shown a blank carton and asked to select the labels that would most/least convince them to purchase the product. The results (below) show that consumers care more about overall health benefits of a milk product than they do specific product attributes; labels such as ‘All Natural’, ‘Heart Healthy’, ‘Enriched with Vitamins’, and ‘USDA Organic’ are far more likely to convince consumers to buy a milk product compared to singular attributes such as ‘Low Carb’, 'Sugar Free’, or ‘Low Fat’.

For more on quantilope's 2021 Food Trends study, including implicit associations with food, an additional MaxDiff on grocery shopping behaviors, and more specific cuts of various dietary trends, check out the full interactive dashboard below!

For more on quantilope's 2021 Food Trends study, including implicit associations with food, an additional MaxDiff on grocery shopping behaviors, and more specific cuts of various dietary trends, check out the full interactive dashboard below!