This blog highlights some key market research questions to ask for actionable customer feedback.

Table of Contents:

Why ask market research questions?

Market research questions help us get to the core of consumer behavior - such as why consumers act the way they do and how they go about their buyers’ journey. Market research surveys are a means of answering these questions, so brands can optimize their offerings (be it products or services) according to customer needs. Without asking your customer base what they want or need, you’re left making assumptions that may or may not hit the mark—which can lead to a waste of valuable time and budget.

Back to Table of Contents

Types of market research questions to ask

Some of the most basic examples of market research questions are those related to demographics (who consumers are), yet these are some of the most foundational questions a survey can ask to make other insights more powerful. Beyond demographic traits, psychographics (what consumers are like: attitudes, aspirations, etc.) and behavioral questions (how consumers act) also paint a detailed picture of a target market.

Below we'll cover some types and examples of market research questions that can help make better business decisions.

Demographic questions

-

Where do you live?

-

How old are you?

-

What is your gender?

-

What is your current marital status?

-

What is the highest level of education you have completed?

-

What is your current employment status?

-

What's your household's annual income?

Psychographic questions

-

What interests you?

-

How do you like to spend your free time?

-

What are your goals for the year?

-

What are your top three priorities in life?

-

How comfortable are you with trying new things?

-

What are your views on social issues like climate change, inequality, or political polarization?

-

How important is it for you to be seen as successful by others?

Behavioral questions

-

How often do you grocery shop?

-

Do you prefer to shop in-store or online?

-

On which days of the week are you most likely to watch television (and subsequently see advertising)?

-

How much money do you usually spend on X products?

-

Which retail brands do you buy from and why?

- Think about a time you recommended a product or service to someone else. What made you so enthusiastic about it?

- Have you ever participated in a brand's loyalty program or rewards system? If yes, what did you like about it?

Back to Table of Contents

Market research questions for different research goals

The type of questions you’ll want to ask in your market research survey will depend on your research goals. Are you trying to get to know your existing customers? Are you looking to engage with potential customers? Are you hoping to conduct a competitive analysis for your brand? A survey could be crafted around any or all of these objectives to fully explore each topic.

Once you determine the goal of your research, you can begin drafting your questionnaire using some of the question types above. Beyond capturing basic demographic questions among every survey respondent, below are a few examples of psychographic and behavioral question types:

For existing customers:

For brands who already have a solid customer base and want to get to know them better to improve customer retention, ask things like:

-

Why did you start using our [product or service]?

-

Would you buy from us again?

-

Would you recommend us to your family and friends?

-

Are there similar products that you use for different reasons?

-

What, if anything, would you improve about or product or service?

For potential customers:

If you’re looking to gather information about new customers you don’t already reach, get to know them through in-depth market research survey questions:

-

What factors influence your purchasing decision when shopping for a new [product or service type]?

-

Which of the following products [or services] are most appealing to you?

-

Where do you typically shop for [product or service]?

-

When will you be in the market for a new [product or service]?

-

How much do you typically spend on a new [product or service]?

For products:

Surveys are a great tool to test reactions and perceptions of your product before you finalize it for launch. Below are some examples of market research questions for a new product to develop a final offering that fits what customers want:

-

What are the most/least important elements of a [product type]?

-

Which scents/flavors do you find most pleasant in our existing product line? Which ones do you hope to see in the future?

-

What pain points are you looking for a product/service to solve?

-

How does this product compare to others on the market?

For pricing:

Once you have settled on a product, you’ll need to determine the pricing for it. You can’t just set any price you want and expect consumers to pay it. The best way to go about pricing decisions is to actually survey your target customers to see what they’d be willing to spend:

-

Do you think the product is priced fairly?

-

What do you think is the ideal price for our [product or service]?

-

Are there any conditions in which you’d pay a higher price for our [product or service]?

-

What price is so high that you’d not even consider buying our [product or service]? (i.e. price sensitivity).

For branding:

Lastly, a brand might have its target audience figured out, with a solid product that’s appropriately priced, but it needs to be marketed and branded. Ask questions like:

-

Are you familiar with our brand? (i.e. brand awareness)

-

Describe your customer experience so far with our brand.

-

How would you rate your customer satisfaction with our brand?

-

How likely are you to recommend our brand to family and friends?

For more on branding, consider a brand health tracker that can capture Category Entry Points and the Mental Availability of brands:

How to use market research questions in a survey

When designing a market research survey, careful consideration should be given to both the formatting of the questions and their overall structure. Getting these aspects right can significantly improve the quality and depth of the actual insights you gather - empowering you to make better business decisions.

Below we'll explore various question formatting options, including open-ended and closed-ended questions, as well as tips to create a logical flow throughout your questionnaire.

Question formatting options

Once you’ve determined the question content you’d like to ask in your survey, there are multiple ways you can go about actually programming each one. Below are some common question formats, and when to use each one:

-

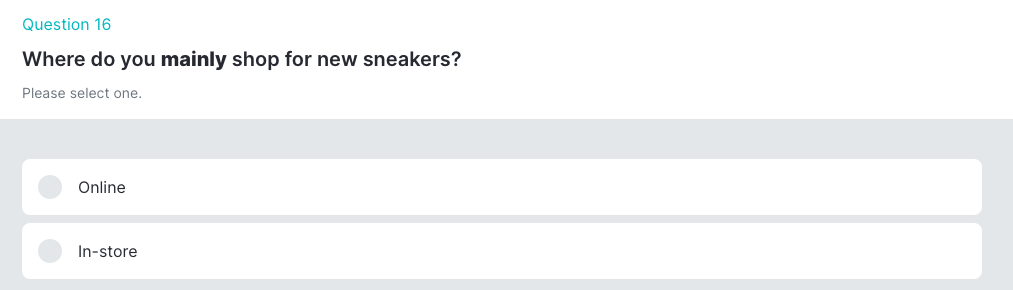

Single select: Use when you want a respondent to select only one item from a list.

-

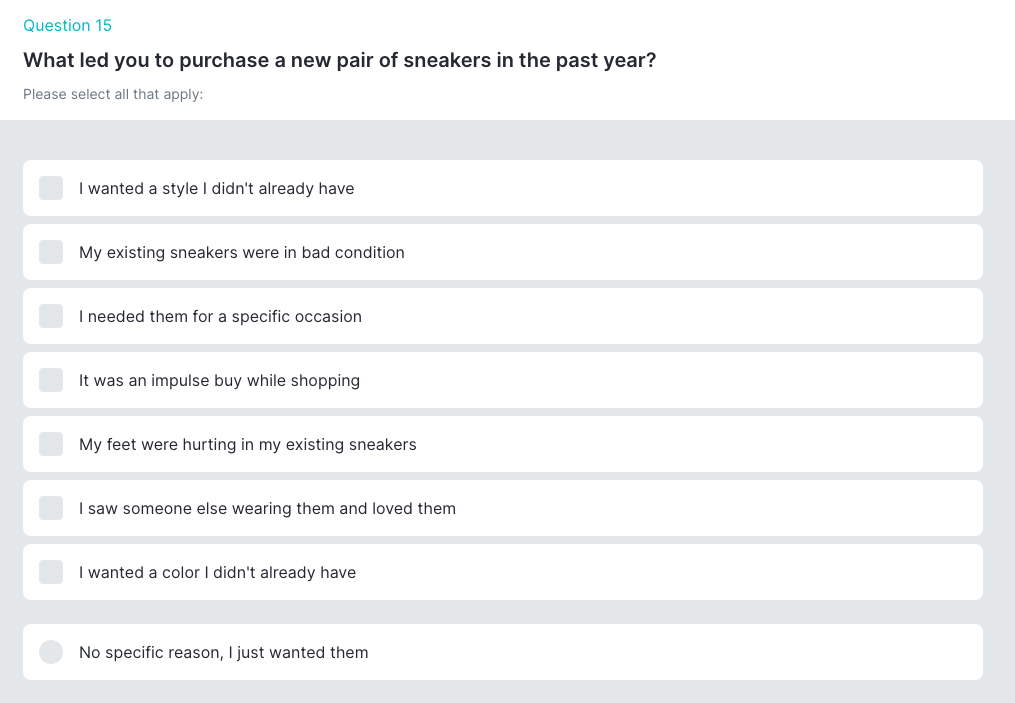

Multi-select: Use when you want a respondent to select as many items as apply to them from a list.

-

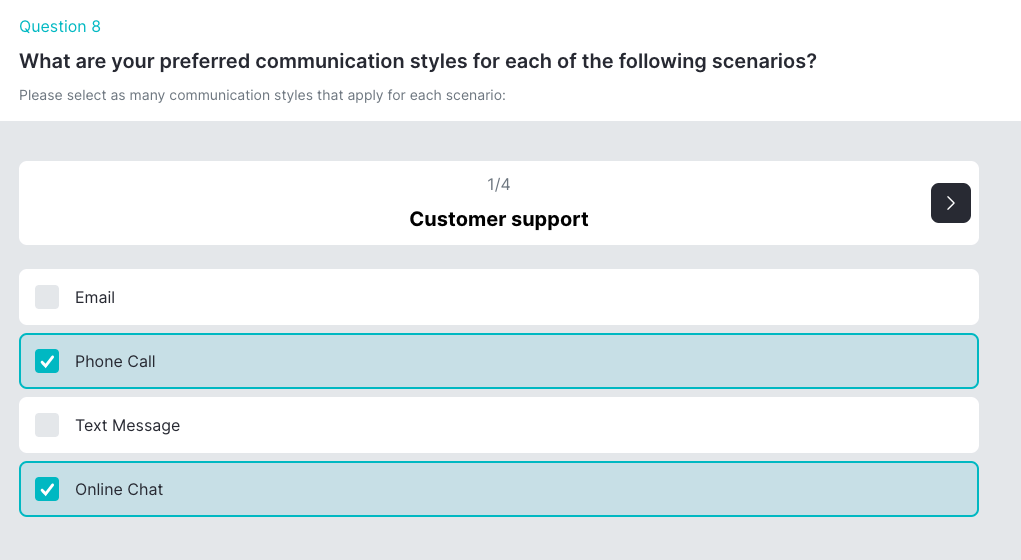

Single/multi-matrix: Use when you want respondents to provide feedback on a list of items. Use a single matrix when you want respondents to select just one response per item, (i.e. yes/no) and a matrix when you want respondents to select multiple responses per item (i.e. in-store and online).

-

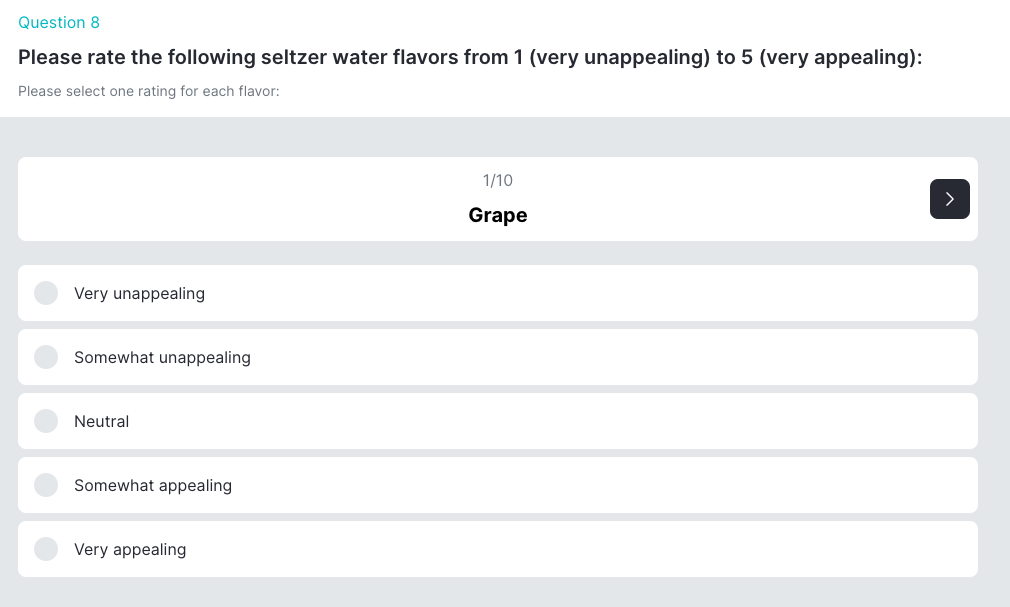

Rating scale/matrix: Use when you want respondents to provide a numeric rating on a single item (scale) or a list of items (matrix); (i.e. 1-5 likeness toward each, 1-5 level of satisfaction with each, etc.)

-

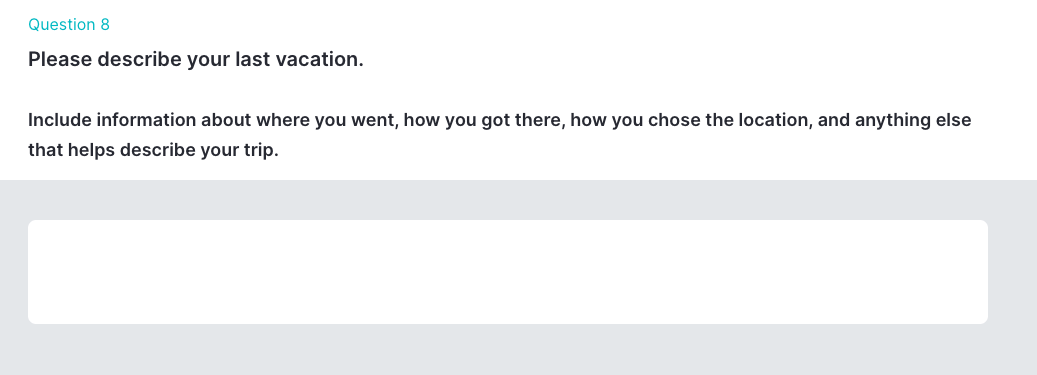

Open-ended questions: Use when you want respondents to provide written feedback to a question (i.e. ‘tell me about your latest shopping experience in-store’, or ‘what do you love about this product/service?;)

How to structure your questions for better insights

Good questions that are thoughtfully structured will guide respondents through your survey smoothly, minimize confusion, encourage complete responses, and ultimately, yield high-quality results to tailor marketing strategies, product development, and customer service initiatives.

Starting with broad inquiries and gradually narrowing the focus enhances respondents' survey experience and enables you to identify patterns and correlations within the data. Below are some tips to keep in mind when structuring your market research survey.

1. Start with a goal

The first step is to set a clear goal for your market research questionnaire. That goal could be to understand your buyer persona, learn how to maintain loyal customers, improve your website’s user experience, increase market share, or launch a new product.

2. Review what you already know

Start by reviewing your own market research findings from past studies to see if you can answer any current questions. You can also look into customer reviews (if available), social media comments, and other external sources to see what people are saying about your brand.

3. Don’t make assumptions

Don’t ever assume you know something about a consumer without data to support it. For example, you may think that all customers use your product/service year-round when really, they’re only using it in the winter. You need to collect data to support any business decisions you’re making. That’s the only way to ensure you’re making good use of your time and budget, and that customer needs are met appropriately.

Back to Table of Contents

quantilope's Consumer Intelligence Platform

quantilope’s automated Consumer Intelligence Platform is equipped with a number of AI-driven features, survey templates, and the largest suite of automated, advanced methods. With results available in real-time, quantilope users can begin diving into customer feedback instantly to adjust strategy as consumer preferences are changing.

Ready to collect data for your own market research study? Get in touch below: