In its third wave, quantilope’s mattress tracker reveals how DTC brands are growing in popularity among consumers.

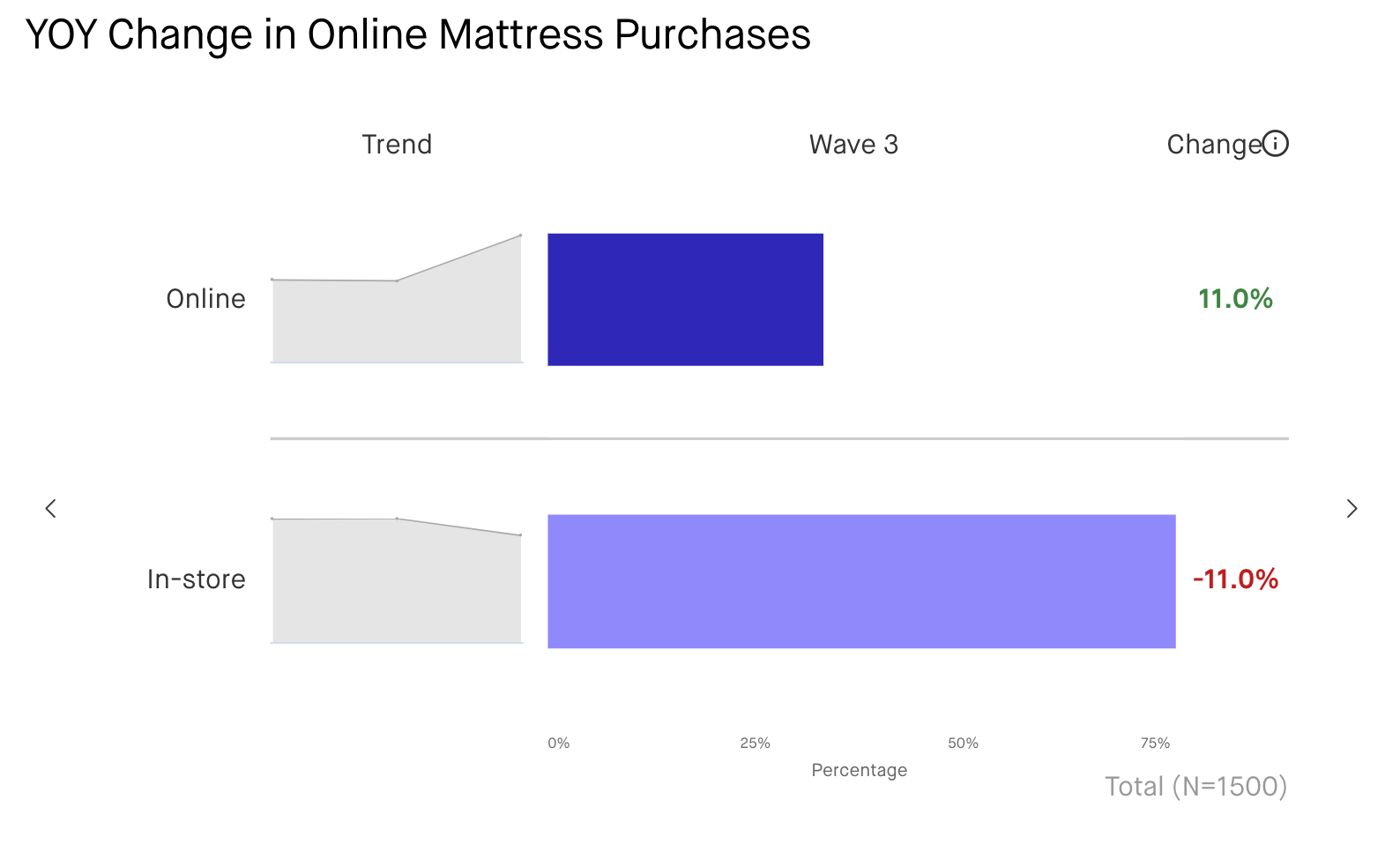

Since August 2019, quantilope’s tracker has monitored mattress brands, their performance in the brand funnel, and how DTC brands in the category stack up against heritage players. Surveying 1500 US consumers across three waves, the study reveals an 11 percent increase in the number of consumers who reported purchasing their last mattress online, alongside an 11 percent decline in those who purchased in-store.

Data from the tracker also indicates that consumers are holding off on bigger ticket items like mattresses (and potentially other furniture items) right now due to the pandemic and the uncertainties that come with it. Wave 3 shows that 50 percent of consumers plan to wait two or more years to buy their next mattress, compared to just 34 percent in wave 2. Similarly, only 7 percent of consumers plan to buy a new mattress in the next 2 months, a 5 percent drop since the previous wave.

Data from the tracker also indicates that consumers are holding off on bigger ticket items like mattresses (and potentially other furniture items) right now due to the pandemic and the uncertainties that come with it. Wave 3 shows that 50 percent of consumers plan to wait two or more years to buy their next mattress, compared to just 34 percent in wave 2. Similarly, only 7 percent of consumers plan to buy a new mattress in the next 2 months, a 5 percent drop since the previous wave.

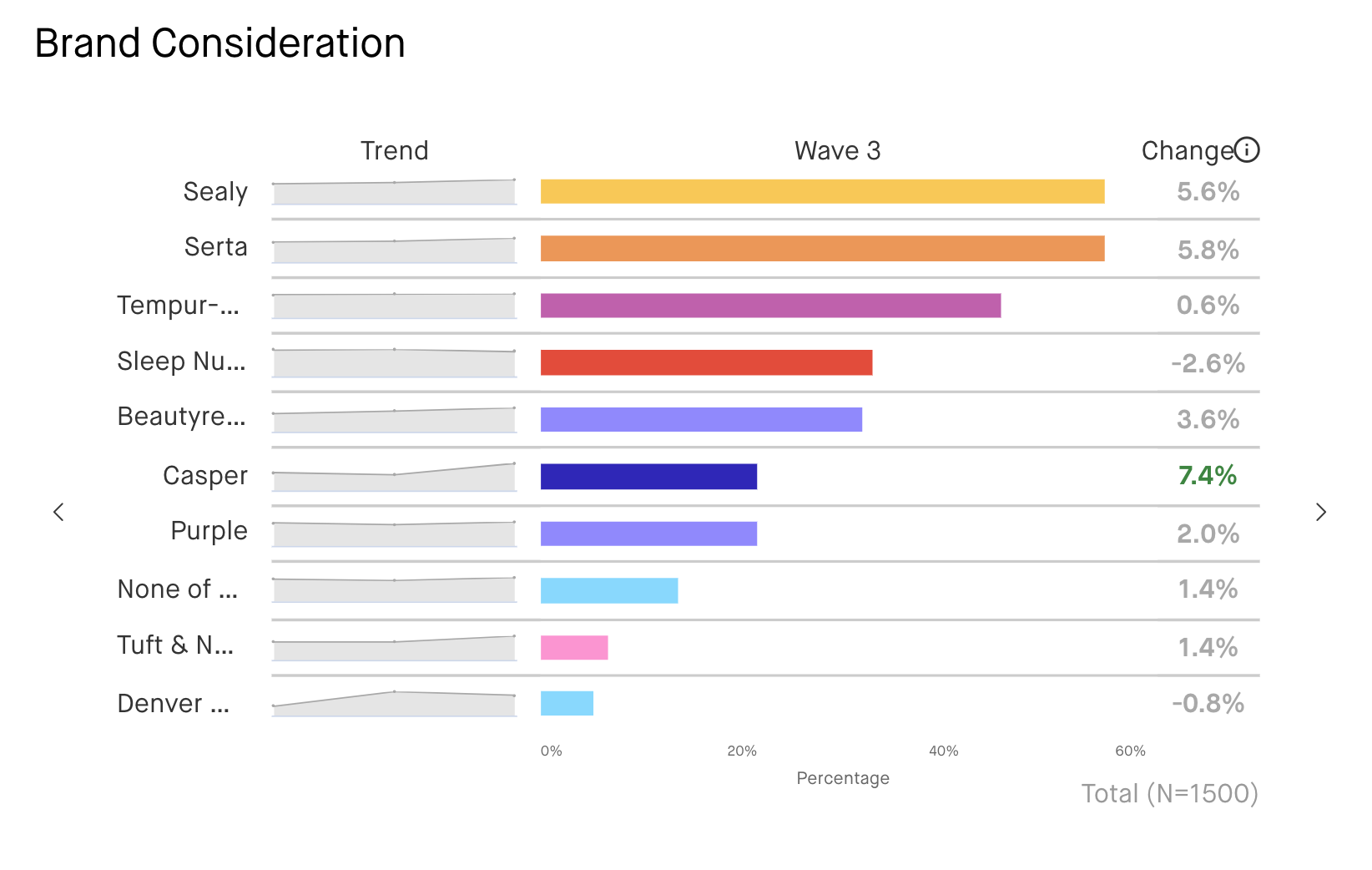

While heritage brands like Serta, Sealy, and Tempur-Pedic still have the highest brand awareness, DTC mattress brands are beginning to show a significant increase in brand consideration, usage, and preference. Between waves 2 and 3, Casper saw a 7 percent increase in brand consideration, a 3 percent increase in brand usage, and a 4 percent increase in brand preference. Similarly, awareness for at least one DTC mattress brand went up 10 percent from 52 to 62 percent between waves.

Download the Insights Dashboard below to access the full results from wave 3 of quantilope’s DTC mattress brand tracker. Brands tracked include Beautyrest, Casper, Denver Mattress, Purple, Sealy, Serta, Sleep Numer, Tempurpedic, and Tuft & Needle.