Quantitative question formats

So we’ve covered the kinds of quantitative research questions you might want to answer using market research, but how do these translate into the actual format of questions that you might include on your questionnaire?

Thinking ahead to your reporting process during your questionnaire setup is actually quite important, as the available chart types differ among the types of questions asked; some question data is compatible with bar chart displays, others pie charts, others in trended line graphs, etc. Also consider how well the questions you’re asking will translate onto different devices that your respondents might be using to complete the survey (mobile, PC, or tablet).

Single Select questions

Single select questions are the simplest form of quantitative questioning, as respondents are asked to choose just one answer from a list of items, which tend to be ‘either/or’, ‘yes/no’, or ‘true/false’ questions. These questions are useful when you need to get a clear answer without any qualifying nuances.

For example:

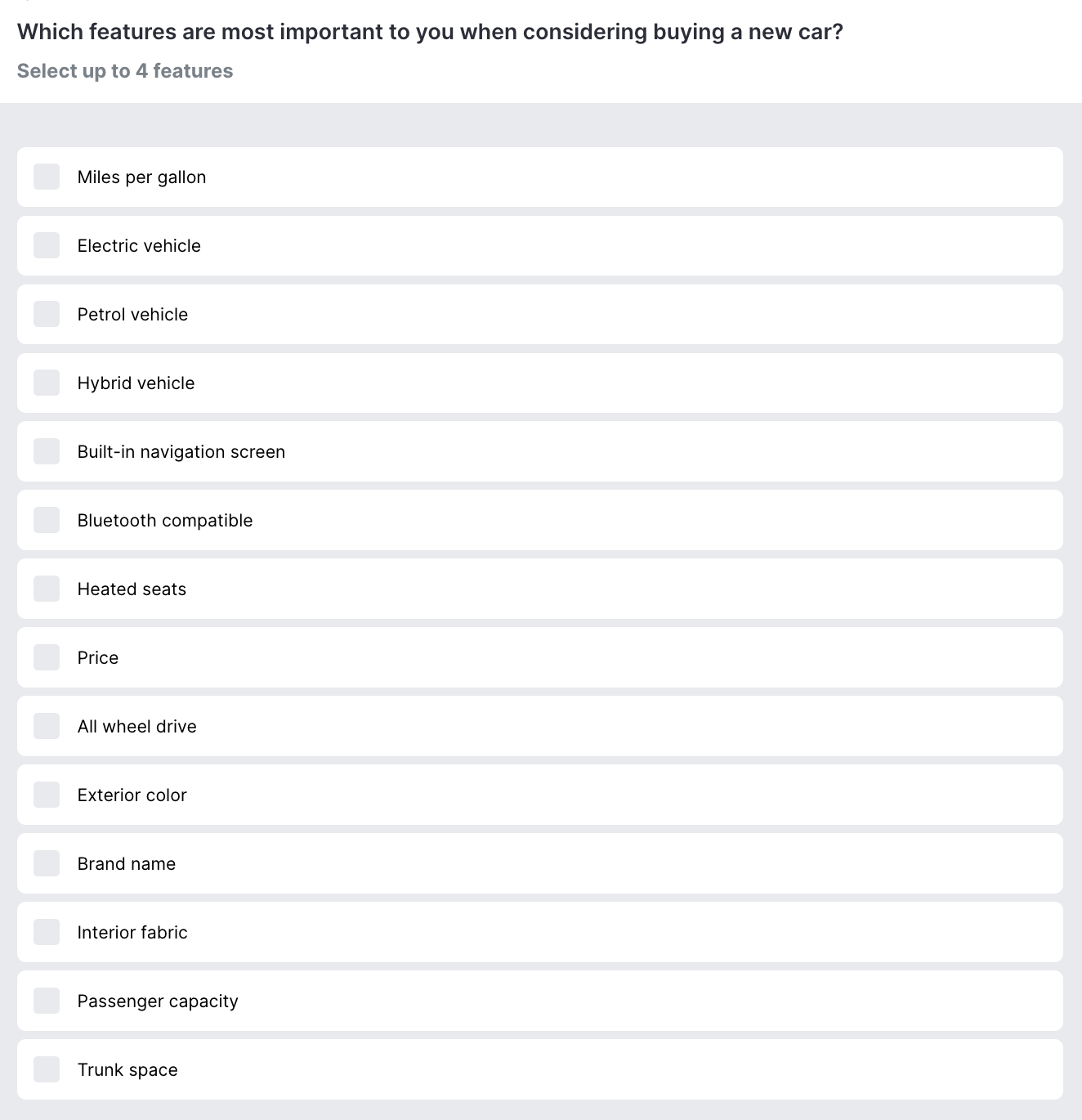

Multi-select questions

Multi-select questions (aka, multiple choice) offer more flexibility for responses, allowing for a number of responses on a single question. Respondents can be asked to ‘check all that apply’ or a cap can be applied (e.g. ‘select up to 3 choices’).

For example:

Aside from asking text-based questions like the above examples, a brand could also use a single or multi-select question to ask respondents to select the image they prefer more (like different iterations of a logo design, packaging options, branding colors, etc.).

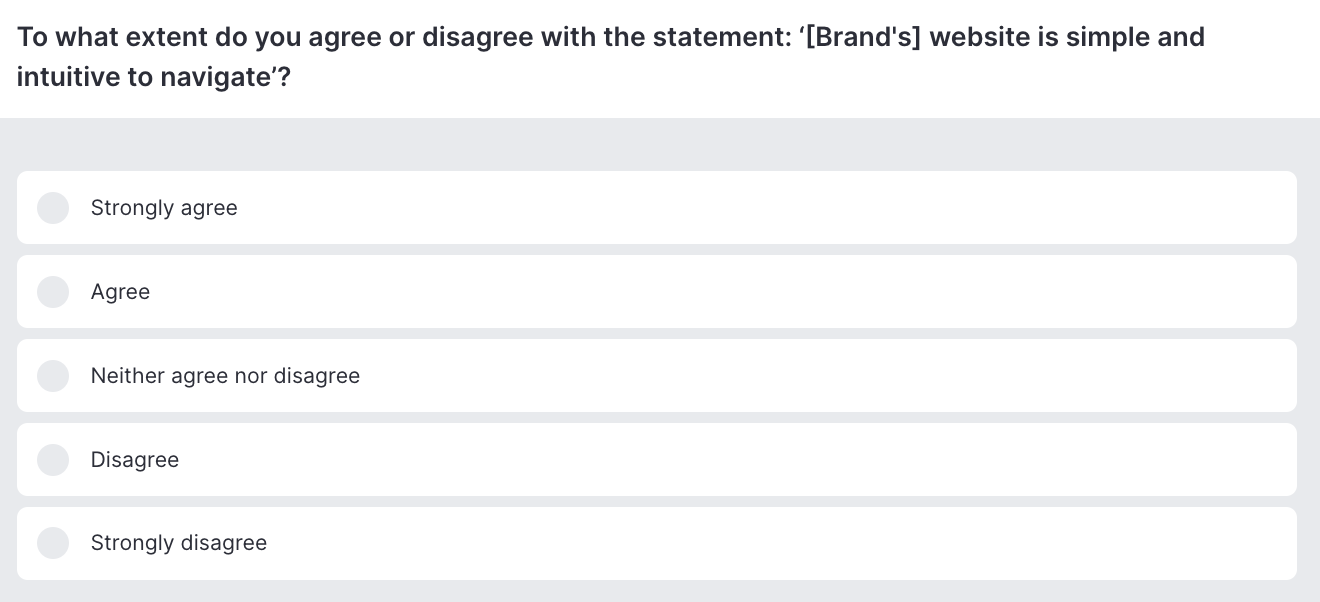

Likert scale questions

A Likert scale is widely used as a convenient and easy-to-interpret rating method. Respondents find it easy to indicate their degree of feelings by selecting the response they most identify with.

For example:

Likert scale questions most often include 5 possible answers, as shown above, but more can be added where needed. One of the most important things to remember when setting up a Likert scale question is to avoid leading questions (e.g. 'How much do you agree that [Brand's] website is simple and intuitive to navigate?'). Asking a question in this fashion already puts into the mind of a respondent that they should agree the website is easy to navigate.

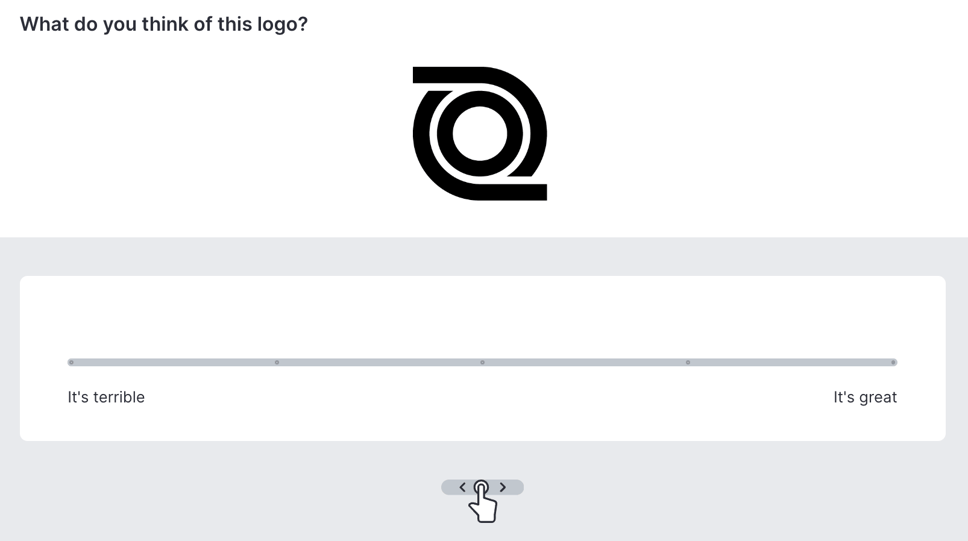

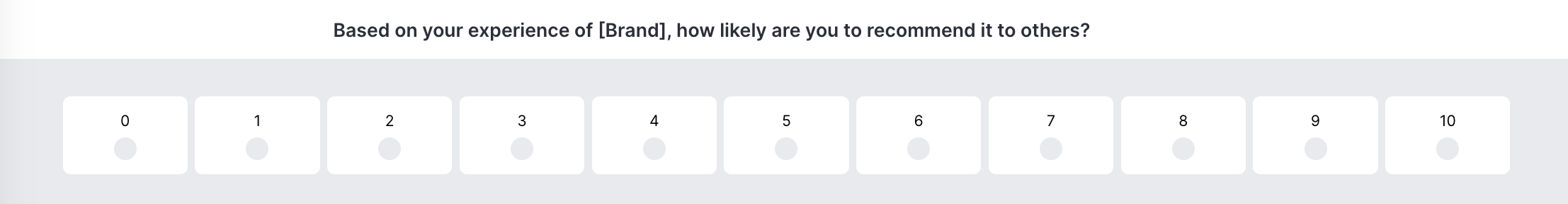

Slider scales

Slider scales are another good interactive way of formatting questions. They allow respondents to customize their level of feeling about a question, with a bit more variance and nuance allowed than a numeric scale:

For example:

One particularly common use of a slider scale in a market research study is known as a NPS (Net Promoter Score) - a way to measure customer experience and loyalty. A 0-10 scale is used to ask customers how likely they are to recommend a brand’s product or services to others. The NPS score is calculated by subtracting the percentage of ‘detractors’ (those who respond with a 0-6) from the percentage of promoters (those who respond with a 9-10). Respondents who select 7-8 are known as ‘passives’.

For example:

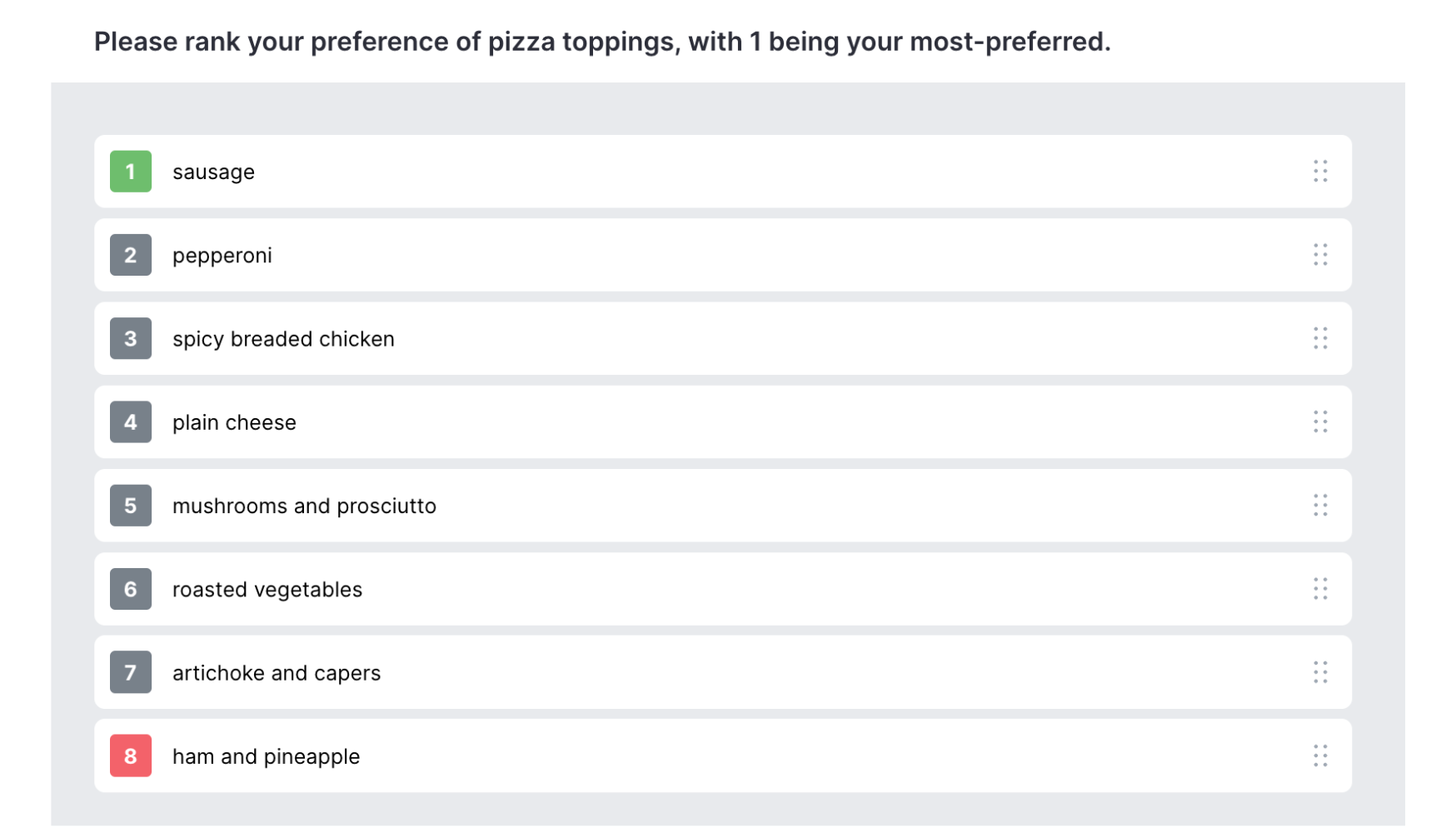

Drag and drop questions

Drag-and-drop question formats are a more ‘gamified’ approach to survey capture as they ask respondents to do more than simply check boxes or slide a scale. Drag-and-drop question formats are great for ranking exercises - asking respondents to place answer options in a certain order by dragging with their mouse.

For example, you could ask survey takers to put pizza toppings in order of preference by dragging options from a list of possible answers to a box displaying their personal preferences:

Matrix questions

Matrix questions are a great way to consolidate a number of questions that ask for the same type of response (e.g. single select yes/no, true/false, or multi-select lists). They are mutually beneficial - making a survey look less daunting for the respondent, and easier for a brand to set up than asking multiple separate questions.

Items in a matrix question are presented one by one, as respondents cycle through the pages selecting one answer for each coffee flavor shown.

For example:

While the above example shows a single-matrix question - meaning a respondent can only select one answer per element (in this case, coffee flavors), a matrix setup can also be used for multiple-choice questions - allowing respondents to choose multiple answers per element shown, or for rating questions - allowing respondents to assign a rating (e.g. 1-5) for a list of elements at once.

Back to table of contents

How to write quantitative survey questions

We’ve reviewed the types of questions you might ask in a quantitative survey, and how you might format those questions, but now for the actual crafting of the content.

When considering which questions to include in your survey, you’ll first want to establish what your research goals are and how these relate to your business goals. For example, thinking about the three types of quantitative survey questions explained above - descriptive, comparative, and relationship-based - which type (or which combination) will best meet your research needs? The questions you ask respondents may be phrased in similar ways no matter what kind of layout you leverage, but you should have a good idea of how you’ll want to analyze the results as that will make it much easier to correctly set up your survey.

Quantitative questions tend to start with words like ‘how much,’ ‘how often,’ ‘to what degree,’ ‘what do you think of,’ ‘which of the following’ - anything that establishes what consumers do or think and that can be assigned a numerical code or value. Be sure to also include ‘other’ or ‘none of the above’ options in your quant questions, accommodating those who don’t feel the pre-set answers reflect their true opinion. As mentioned earlier, you can always include a small number of open-ended questions in your quant survey to account for any ideas or expanded feedback that the pre-coded questions don’t (or can’t) cover.

Back to table of contents

Examples of quantitative survey questions

Quantitative survey questions impose limits on the answers that respondents can choose from, and this is a good thing when it comes to measuring consumer opinions on a large scale and comparing across respondents. A large volume of freeform, open-ended answers is interesting when looking for themes from qualitative studies, but impractical to wade through when dealing with a large sample size, and impossible to subject to statistical analysis.

For example, a quantitative survey might aim to establish consumers' smartphone habits. This could include their frequency of buying a new smartphone, the considerations that drive purchase, which features they use their phone for, and how much they like their smartphone.

Some examples of quantitative survey questions relating to these habits would be:

Q. How often do you buy a new smartphone?

[single select question]

More than once per year

Every 1-2 years

Every 3-5 years

Every 6+ years

Q. Thinking about when you buy a smartphone, please rank the following factors in order of importance:

[drag and drop ranking question]

brand

price

screen size

storage capacity

Q. How often do you use the following features on your smartphone?

[matrix question]

| Many times daily |

Once per day |

Every few days |

Once |

I do not |

|

| Phone call | |||||

| Text Message | |||||

| Social Media | |||||

| Camera |

Q. How do you feel about your current smartphone?

[sliding scale]

I love it <-------> I hate it

Answers from these above questions, and others within the survey, would be analyzed to paint a picture of smartphone usage and attitude trends across a population and its sub-groups. Qualitative research might then be carried out to explore those findings further - for example, people’s detailed attitudes towards their smartphones, how they feel about the amount of time they spend on it, and how features could be improved.

Back to table of contents

Leveraging quantilope for your quantitative survey

quantilope’s Consumer Intelligence Platform specializes in automated, advanced survey insights so that researchers of any skill level can benefit from quick, high-quality consumer insights. With 15 advanced methods to choose from and a wide variety of quantitative question formats, quantilope is your one-stop-shop for all things market research (including its in-depth qualitative research solution - inColor).

When it comes to building your survey, you decide how you want to go about it. You can start with a blank slate and drop questions into your survey from a pre-programmed list, or you can get a head start with a survey template for a particular business use case (like concept testing) and customize from there. Once your survey is ready to launch, simply specify your target audience, connect any panel (quantilope is panel agnostic), and watch as respondents answer questions in your survey in real-time by monitoring the fieldwork section of your project. AI-driven data analysis takes the raw data and converts it into actionable findings so you never have to worry about manual calculations or statistical testing.

Whether you want to run your quantitative study entirely on your own or with the help of a classically trained research team member, the choice is yours on quantilope’s platform. For more information on how quantilope can help with your next quantitative research project, get in touch below!

-1.png?width=1500&height=800&name=Untitled%20design%20(5)-1.png)

.png)